One of the most talked about stories this past week that is still unfolding as this piece is written has been hard to believe trades being carried out with the shares of GameStop. Many if not all reading this may likely never have heard of GameStop before. GameStop is not Tesla, Amazon, Facebook, or NetFlix. GameStop is a struggling brick and mortar video game retailer that has been filing losses and sub-par performance over the years. It is a company that has given a basic understanding of today’s economy, one can say has no significant future ahead of it. It has the physical infrastructure in stores and ware-houses but in a world where everything including video games is being bought online, the appeal of physical stores (especially with Covid-19 lockdowns) seems very little. But these past few weeks, stunning developments from the financial markets have led to GameStop is one of the most talked about and valued stocks there is.

GameStop up till the first week of January was valued at about an average of 20$ per stock and was seen as a poorly performing company with very little future growth scope. It was what one would call in market-terms a ‘heavily shorted’ stock. This meant that big hedge funds and investment companies who usually dominate financial markets had heavily bet on GameStop price further reducing and going lower. In fact, so bleak was the market outlook for GameStop that an overwhelming majority of its shares/stocks were ‘shorted’. Shorting in brief means that a fund or investor has borrowed money from the broker/platform to sell a stock at a certain price with the promise to buy it back later. Thus if the stock's value went down with time, the investor/fund would buy it back cheaper and thus make a profit. If however, the stock's value were to rise it would mean a loss, as it would need to be bought back at a higher price than what it was sold. Indeed big wall-street companies are often criticized for ‘over-shorting’ or ‘ganging up’ on poorly performing companies by collectively shorting massive amounts of stock of the company. They also often create bad PR and direct investigations on these companies so that their value drives down and they can make a profit on this decline in value of the company. In other words, they have a vested interest in de-valuing these companies.

What no one could have foreseen is the madness and sheer ingenuity of a forum of small to medium retail traders called Reddit/Wallstreetbets. What members of this forum possibly acting on intel dropped by a few core individual members (or outsiders) discovered that there are several such stocks like GameStop or AMC which are heavily shorted by wall-street giants and hedge funds. This presents the opportunity for something called a short-squeeze.

`

Caption: Wallstreetbets on Reddit is a forum where high risk and often outlandish trades are discussed.

Short-Squeeze is a scenario when if enough buying demand occurs for a stock that is heavily-shorted, the price begins to gradually increase. Every amount the price increases creates bigger and bigger losses for big hedge funds who have large positions shorted or betting that the value goes down not up. Gradually these hedge funds will need to start buying back some of the stock they ‘sold’ at a lower price. Now if the buyer demand is sustained this will only increase the price and large short positions have to keep on buying to limit their losses. This creates an explosive cascade effect on the price which causes it to rise exponentially. Members of Wallstreet bets on Reddit decided to follow this exact strategy and urged members across the forum to buy GameStop shares.

Caption: Overview of GameStop stock prices over the past few weeks

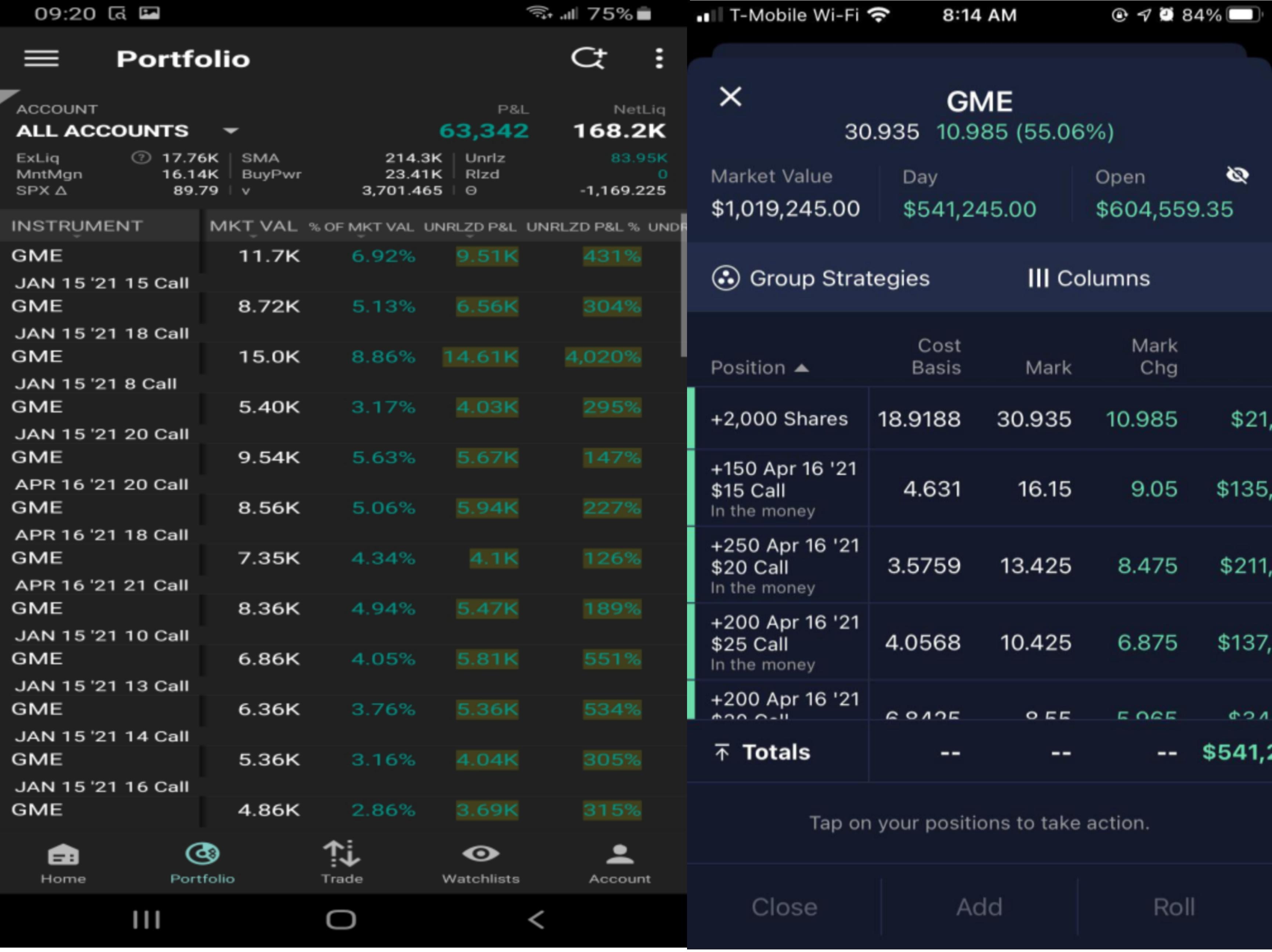

The short-squeeze happened as forecast. From the 12th to the 25th of January increased buying pressure from Redditorforum members caused the price to rise from 20 $ to 76 $, enough for the larger short sellers to start buying back their stocks/shares. This started to trigger a cascading effect and within the days the price shot up to 347 $ in by the 27th of January. Wallstreetbets members who were small individual traders became instant jackpot winners and some even millionaires almost overnight. Users quickly started posting pictures of their winnings online, urging others to jump on to the buying trend and drive the prices even higher.

Caption: Screenshots of users making heavy profits buying GME stocks

There was a flip side to all this. The gains made by individual traders were being made at the expense of large institutional investors and hedge funds. These funds had so heavily shorted Game-Stop that they never considered a scenario when such an exponential price increase would happen. As a result, they now stand heavily exposed with millions and in some cases billions in the loss. Melvin Capital for example lost 7 BN $ (7 billion) US dollars as a result and needed emergency funds pumped in to stay active. The hedge funds have hit back and are calling for a federal investigation as they claim what is happening is pure market collusion. This is somewhat true as it cannot be denied that the forum members are indeed colluding to drive the prices of this stock up. But in the same argument wasn’t the fact that all these large hedge funds collectively shorting the stock also a form of collusion. Haven’t the lessons from the financial crash of 2008 taught us that large hedge funds are inherently subject to insider trading and market manipulation? So why complain when the small individual investors do it.

The Game-Stop price surge is an on-going saga that might still hold some twists. Over the last few days, the massive surge in price has stopped and has seen two small crashes with a gradual trend starting to get back to much lower levels. However many in the Reddit community are still not selling. Indeed a whole new wave of small investors have jumped in and are buying to keep the demand pressure up and continue the price rise. For them, the motivation is not purely making a profit. They see this as finally a chance to have their say and take revenge on large hedge funds who have been accused of long standing market manipulation and partial government treatment. Indeed the popular trading platform Robinhood even temporarily halted buying of GameStop shares in what was seen as openly siding with large hedge funds and not letting the market operate freely.

Caption: Billionaire Lee Cooperman on TV condemning the GameStop buying frenzy

Regardless of whether GME prices go up again or finally come back down, the effects of the past few days will be felt in the weeks if not months to come. The damage done to large hedge-funds will slowly start coming out to the public and there are already fears of 2008 like economic crash looming as a result. Individual traders no longer view this as an investment or trading opportunity but as a full-on revolution against the dominance of hedge funds. Rumors are on-going about a coming short-squeeze on silver which is also heavily shorted by hedge funds. However, words of caution have already been sounded to over-zealous traders who may heavily lose out in the end as hedge funds begin to understand and plan for what is currently happening in the market. Ultimately after the madness, someone will be left to foot the bill. The question is will it be the large Wall-Street institutions or the small individual traders who held on to Game-Stop stocks in a bid to take down Wall-Street.